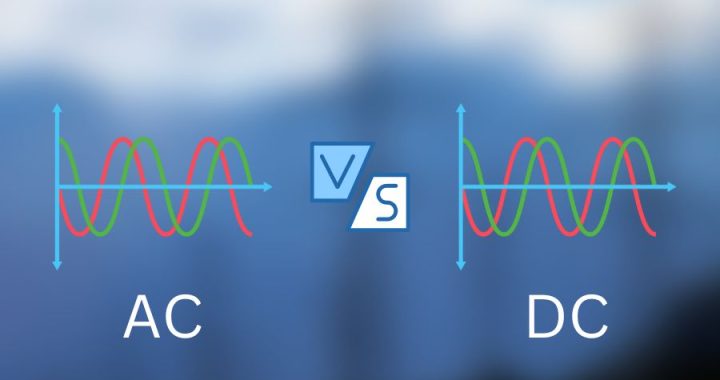

In electronics, especially in signal processing and transmission, two standard methods are used to couple signals between devices: AC coupled vs DC coupled approaches.

Both techniques have advantages and considerations, making it crucial to understand their differences and choose the appropriate method for specific applications.

In this context, understanding the relationship between voltage, current, and power is essential, and tools like an ‘amps to watts calculator‘ or a ‘volts to watts calculator’ can be invaluable.

This ...... Read More

Ireland’s commitment to clean energy and sustainable practices has gained significant momentum recently. As the country strives to reduce carbon emissions and transition to a greener future, innovative technologies play a crucial role. One such innovation is the Tesla Powerwall, a cutting-edge energy storage solution that is transforming how we store and utilize electricity.

In this article, we will explore the features, benefits, and potential impact of Tesla Powerwall in Ireland, drawing on data and information from reputable ...... Read More

Energy Vault, a gravity-based power storage provider, has begun building on its first commercial-scale project. The 100MWh battery pack is being constructed near a wind generator in Rudong, Jiangsu State, China, just east of Shanghai.

According to the announcement, this implies the firm’s approach is cost-effective and environmentally benign, allowing the usage of renewable energy from moments when demand is low to instances when capacity is mostly required during peak hours.

...... Read More

Neara is growing globally, with a key orientation on the United States, to assist energy providers in managing the increasing effects of global warming, improving network stability, and accelerating clean energy integration. The company confirmed a $14 million Series B fundraising round.

Neara intends to address the most pressing concerns confronting utilities, such as an increasingly unstable ecosystem, catastrophic weather occurrences, and obligations to increase renewable ...... Read More

The transition to renewable power will help reduce emissions of carbon dioxide, but it will place tremendous strain on the grid. The greatest available solution to this challenge may be new, grid-scale storage initiatives.

The most common kinds of renewable energy, unlike fossil fuel-fired power facilities, cannot dynamically adjust production to meet consumption. Even in locations with significant renewable energy ...... Read More

Artificial intelligence (AI) is being used in utility applications. While AI is nowhere near a new phenomenon, modern IT systems with superior machine learning algorithms are revolutionizing the sector by bringing analytical skills to potentially enormous, diverse datasets for modeling and administration in near real-time.

Combine this with other current IT advances such as the cloud service, which can provide immediate access to AI capabilities, and edge computing, which provides data handling and latency improvements, and it is no wonder that AI is now ...... Read More

AC Coupled vs DC Coupled

AC Coupled vs DC Coupled  Tesla Powerwall Ireland

Tesla Powerwall Ireland  Energy Vault Begins Development on the First Gravity-Based Storage Installation

Energy Vault Begins Development on the First Gravity-Based Storage Installation  ERG and Onyx Insight Make It Possible to Analyze the European Wind Portfolio In-House

ERG and Onyx Insight Make It Possible to Analyze the European Wind Portfolio In-House  Stellantis and Samsung Collaborate to Build a 23GWH Ev Indiana Facility

Stellantis and Samsung Collaborate to Build a 23GWH Ev Indiana Facility